EigenLayer: Doubling the Stakes

Actionable Insights

If you only have a few minutes to spare, here are the key things you should know about EigenLayer:

Zero marginal cost and capital efficient: EigenLayer uses already staked ETH and restakes it into its own contract. You (as a staker) are subjecting your stake to additional slashing conditions while being compensated through any rewards EigenLayer and other applications provide.

Reduces barriers to entry: Middleware (oracles, bridges, etc.) and dApps previously had to solve a technical and a capital problem in order to bootstrap a trust network. Solutions such as Chainlink had to first create an oracle and also somehow bootstrap a cryptoeconomic network to get where it is today. EigenLayer abstracts the capital bootstrapping problem by leveraging ETH's trust to secure applications built on top of EigenLayer.

EigenLayer is making some noise in the crypto ecosystem. Not only does it have a dope name, but the team is filled with based people. Just the name itself scares many non-math people. But I assure you that once you understand the basic principles, EigenLayer is not hard to understand. You will even learn why I think it's called EigenLayer later. ;)

This piece primarily focuses on market structure and value capture (less on origin story/team). Creating a thesis around EigenLayer and the role it plays in the future, I think, provides a more intellectually interesting piece.

What is EigenLayer?

In 1 sentence

Crypto/Finance Definition

By opting-into EigenLayer, you are rehypothecating your already staked ETH and receive rewards for the additional risk of lending trust to applications.

For Everyone

EigenLayer is a zero marginal cost solution that creates an open marketplace for trust suppliers (stakers/validators) and trust consumers (middlewares).

Literally, EigenLayer is a set of smart contracts deployed to the Ethereum network. On a technical level, the key piece of code is that the withdrawal credentials is set to the EigenLayer smart contracts. This means that you (as a staker) are agreeing to adhere to all of the components laid out in the EigenLayer smart contracts, which adds additional slashing risks to your staked ETH.

The key innovation is that EigenLayer provides a platform to decouple technical innovations from creating a trust network (which is often very capital intensive). This allows middleware solutions to focus solely on bringing the technical innovation to the table.

Team

I'm not going to go into much detail here but know that these are some of the sharpest people in crypto.

You can learn more about EigenLayer and their team here.

Why is it called EigenLayer?

I have not formally asked the team why they named their project EigenLayer. But this is my interpretation by connecting some dots together:

- Eigen means characteristic -- therefore EigenLayer refers to the characteristic layer.

- Critically, eigenvectors don't change the direction but only the scalar factor. Similarly, EigenLayer does not change the direction of Ethereum (in fact, all the incentives are aligned) but amplifies the network effects and trust layer provided by Ethereum. More on this later.

EigenLayer Stakeholders

First, we must assume that Ethereum successfully transitions to Proof-of-Stake. This is scheduled to occur but there is a non-zero chance that it does not occur/something goes wrong.

EigenLayer is effectively a two-sided marketplace of suppliers and consumers. Let's investigate:

Staker Incentives (Trust Suppliers)

Stakers would rationally opt-into EigenLayer when their marginal revenue is greater than their marginal cost (MR > MC). The marginal cost for the re-staked or rehypothecated ETH is zero and the marginal revenue is any revenue that a given application on top of EigenLayer provides.

While there are no explicit marginal costs, there is obviously risk that re-stakers are opting into and being compensated for. This is the risk of being slashed. The staker inherits all of the risks associated with providing trust to a given network. What's really cool about EigenLayer is that you can opt-in to specific applications that you want to provide trust for. Say you want to provide trust to a given oracle but not to a data availability layer. You can do that with EigenLayer. This creates an efficient market where there is a marketplace between trust suppliers and trust consumers.

As a rule of thumb in crypto, the further down the stack you go, the larger the contagion effects are if things go wrong. EigenLayer is working on modeling certain outcomes but nothing is for certain.

Middleware Incentives (Trust Consumers)

Middlewares -- or any applications built on top of EigenLayer -- would utilize EigenLayer to solely focus on providing a technical innovation without the capital requirements and hassle around bootstrapping a novel trust network.

Creating your own trust network is extremely capital demanding and difficult. In first principles, you are creating your own crypto-economic game -- in a POS system this would include stakers staking their capital and receiving rewards for correctly performed tasks and get slashed for incorrectly performed tasks. The budget constraint is not the operational cost of the network but rather the economic capital base and your crypto-economic structure.

In essence, your crypto-economic game has to provide enough incentive for stakers to keep playing your game, taking into account the cost of capital.

Is EigenLayer Parasitic to Ethereum?

Incentive Alignment

Unlike some L2s and sidechains, EigenLayer is directly aligned with Ethereum (ETH) and the Ethereum ecosystem:

- ETH benefits because more applications leverage ETH trust, therefore increasing its network effects.

- EigenLayer benefits because more capital is being re-staked on EigenLayer smart contracts, increasing revenue (via fees) and creates its own network effect for any application seeking a decentralized trust network.

- Middleware solutions benefit because they are able to leverage Ethereum's trust and focus on bringing new innovations to the ETH ecosystem.

- DApps benefit because there are more middleware solutions to utilize and compose with, spawning new products and product features.

Appchains

There has been a recent trend of appchains developing their sovereign blockchains. Applications such as dydx are using the Cosmos SDK to create their own standalone blockchains. Dydx is doing this for multiple reasons including to:

- not suffer from fee congestion from other activities on the L1 chain

- capture MEV value

These are just some benefits of owning the entire stack. However, dydx likely would not have succeeded if it had started out with dealing with all the complexities of running their own chain. In a world where appchains proliferate in numbers, I expect many of them to initially bootstrap their idea and network on EigenLayer and perhaps branching off into their own chain as they have more capital and leverage in the crypto ecosystem.

Obviously, there are some drawbacks from creating your own sovereign blockchain. The biggest is the fact that you lose composability -- it is much harder for your application and other applications to compose with each other.

I fully expect appchains to proliferate as there are a lot of benefits of owning the full stack. However, only sufficiently large applications have the luxury of doing this. The presence of EigenLayer democratizes access to trust networks and allows the best technical innovations to win, decoupling the many problems/high capital requirements associated with starting up your own trust network from scratch.

As a result, I think we will see the best apps in the next few years going through this pipeline:

- Develop a new middleware solution and leverage EigenLayer to provide the trust network.

- Accrue significant revenue and popularity (still on EigenLayer).

- Launch its own chain (leveraging the Cosmos SDK or something similar).

EigenLayer Theses/Predictions

The following is a list of scattered thoughts around EigenLayer. Each of these predictions deserves their own blog posts, which I will hopefully write in the near future.

The EigenLayer "stake" will grow linearly to the applications/middlewares that it supports via its trust network.

As noted by Joel Monegro in his prescient Fat Protocols essay, value is accrued at the base layer of blockchains (unlike internet infrastructure).

As the Ethereum ecosystem has grown over the past few years, we have witnessed a relatively linear growth relationship between the Ethereum stake and the value of the decentralized applications it supports. I believe that we will see the same phenomenon occur with EigenLayer. Because they are providing the smart contracts that delegate trust, they themselves must viewed by the market to be trustworthy and I believe will be valued in a similar manner to Ethereum.

Let's look at the incentives as it relates to security of EigenLayer:

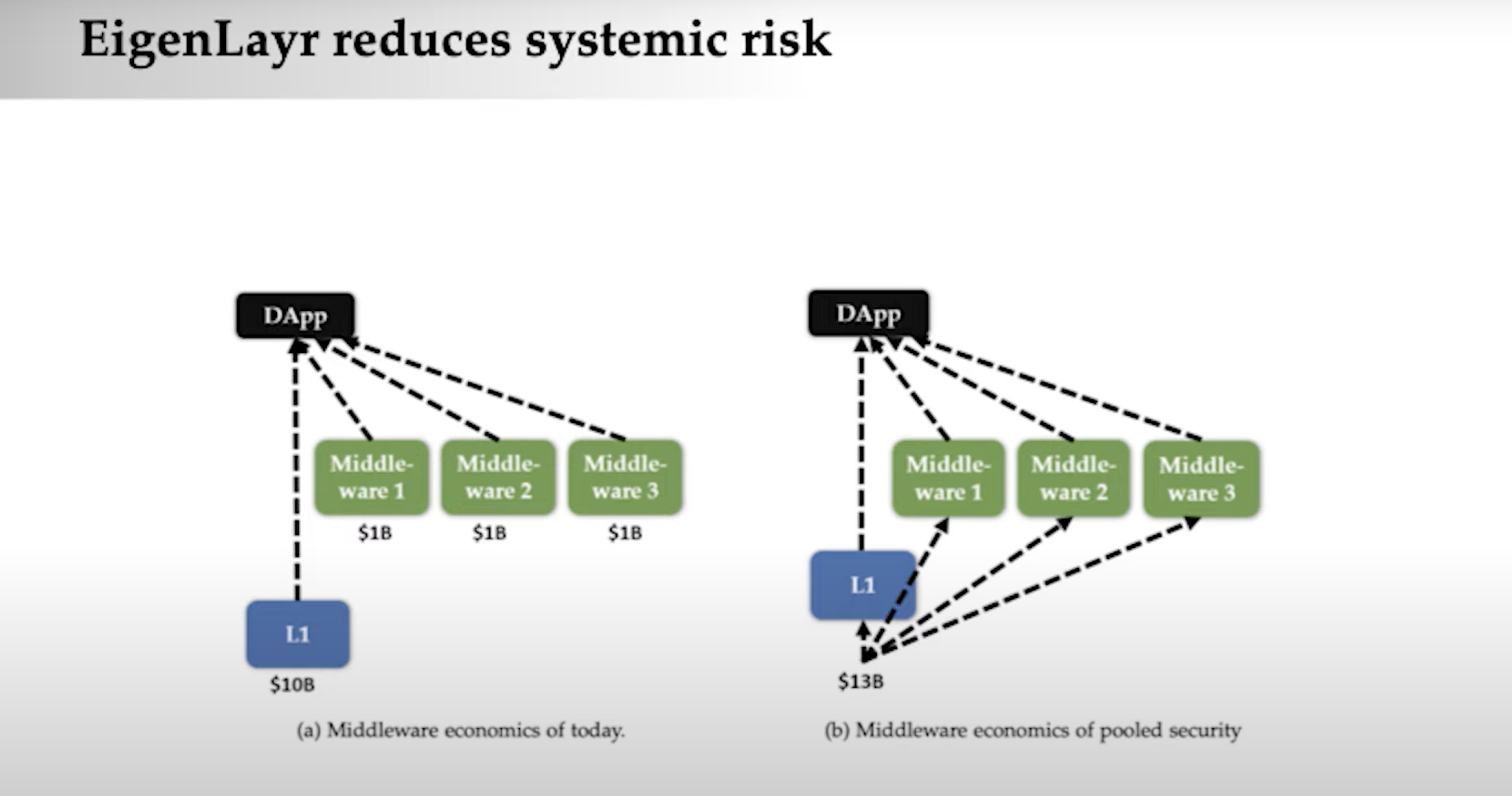

(Taken from EigenLayer's a16z crypto talk)

Because the security of the system is derived from the weakest link in the system, in system (a), the economic security is $1B while in system (b), the economic security of the system is $13B. The system's risk profile goes from the min() to the sum() by pooling security in this manner.

As more and more stakers "opt-in" to EigenLayer, this not only increases EigenLayer's security (increases the amount of capital required for attacks) but also allows more value to be accrued to the base layer of the trust network (EigenLayer itself).

An aggregator built on top of EigenLayer will emerge for efficient allocation of re-staked assets, similar to 1inch aggregating across a wide array of trading venues.

This seems obvious even though stakers are generally more informed market participants compared to most retail traders. However, given the expansive suite of products that will likely be built on top of EigenLayer (and given crypto's tendency to build aggregators on top of everything), this seems like a logical piece of software to be built in the future.

Because EigenLayer allows for more staker heterogeneity -- stakers can vote with their ETH on what they value and the type of future they want to fund -- this will likely lead to different "pools" of risk/return with respect to a different set of middlewares that each staker would like to support.

Conclusion

EigenLayer is a cool piece of infrastructure that could prove to be very valuable to the Ethereum stack. It completely decouples the technical innovation from the capital and resources required to bootstrap your own trust network. I believe that this will lead to novel innovations that would not have spawned without EigenLayer.

I think that the key open-ended questions whose answers will determine EigenLayer's success are:

- Will EigenLayer themselves (or others) develop this infrastructure on other chains (similar to Flashbots on Ethereum and Jito Labs on Solana)?

- Are developers actually going to build on top of EigenLayer?

- Will EigenLayer compensate re-stakers via native ETH or through a native token?

- Are EigenLayer's smart contracts themselves secure?

I think that the answers are 1) yes 2) yes 3) probably native ETH at first, then a token and 4) probably, but time will tell. Anything that reaches this deep into the stack and is dealing with native staked ETH must be audited and tested to the fullest extent.

If everything works according to plan, I can see EigenLayer becoming the dominant layer where the best middleware solutions of the coming decade are built on.